Industries with stable Spring employment gains

There were five—and only five—BLS-categorized industries where seasonally adjusted job numbers appeared untouched by the economic downturn in the months of April and May 2020. The gold medal winners are:

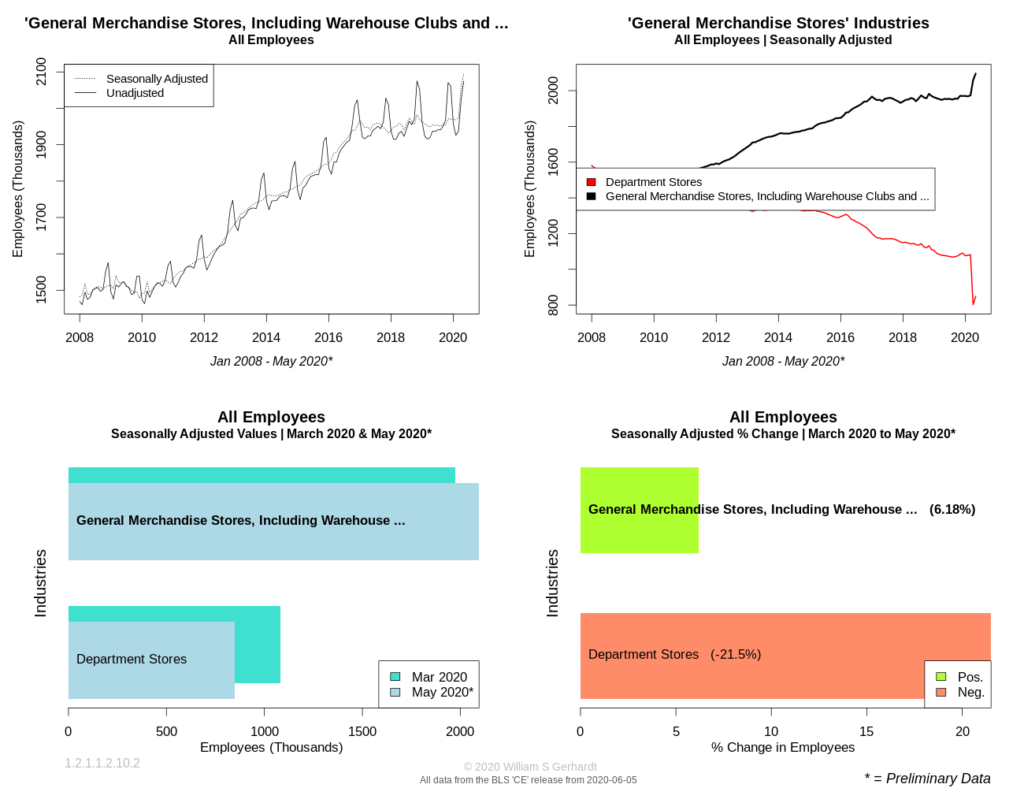

1) General Merchandise Stores, Including Warehouse Clubs and Supercenters

In the early days of the pandemic many States forced the closure of all stores with the exception of big box retailers: those with in-store groceries or pharmacies. As restaurants and bars were closed, grocery stores around the nation must have experienced increased demand for their “essential” services (food and booze), and the increase in industry employment appears reflect that.

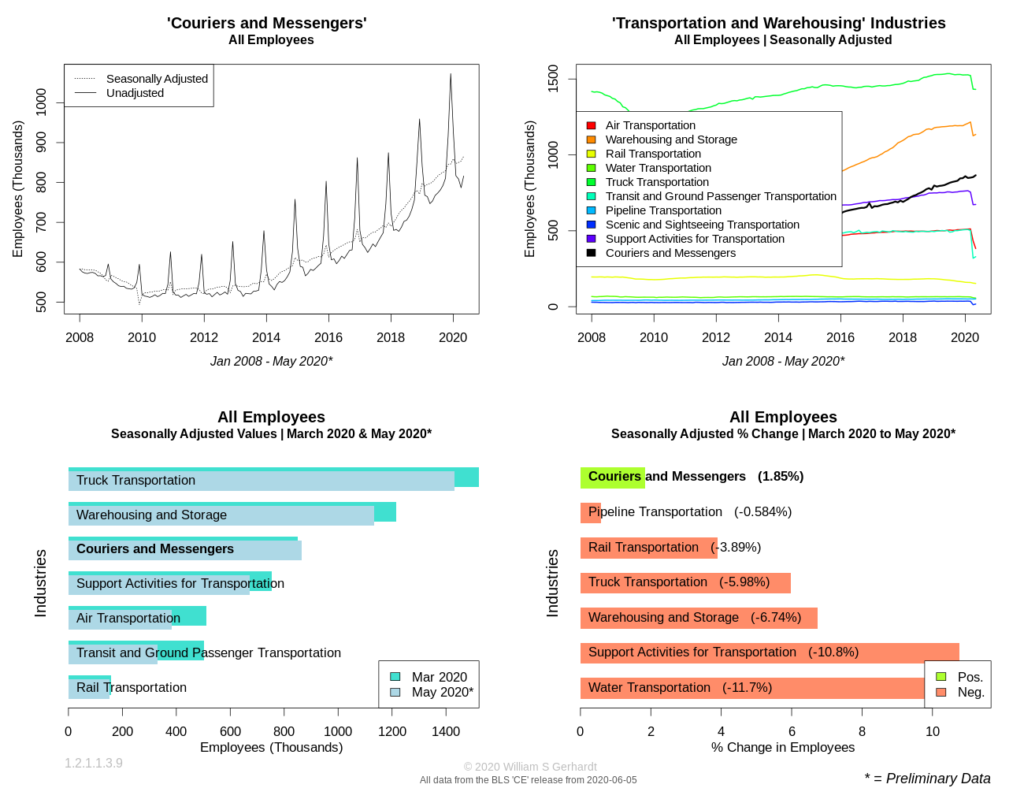

2) Couriers and Messengers

As they say: if you can’t find it in-store, buy it online. I couldn’t easily tell if food delivery companies are included in the “courier” category, but private shipment companies were. The increased consumer demand for item delivery has clearly resulted in an increased demand for front-line delivery employees, even as employment in sibling transportation sectors (such as truck transportation) dropped.

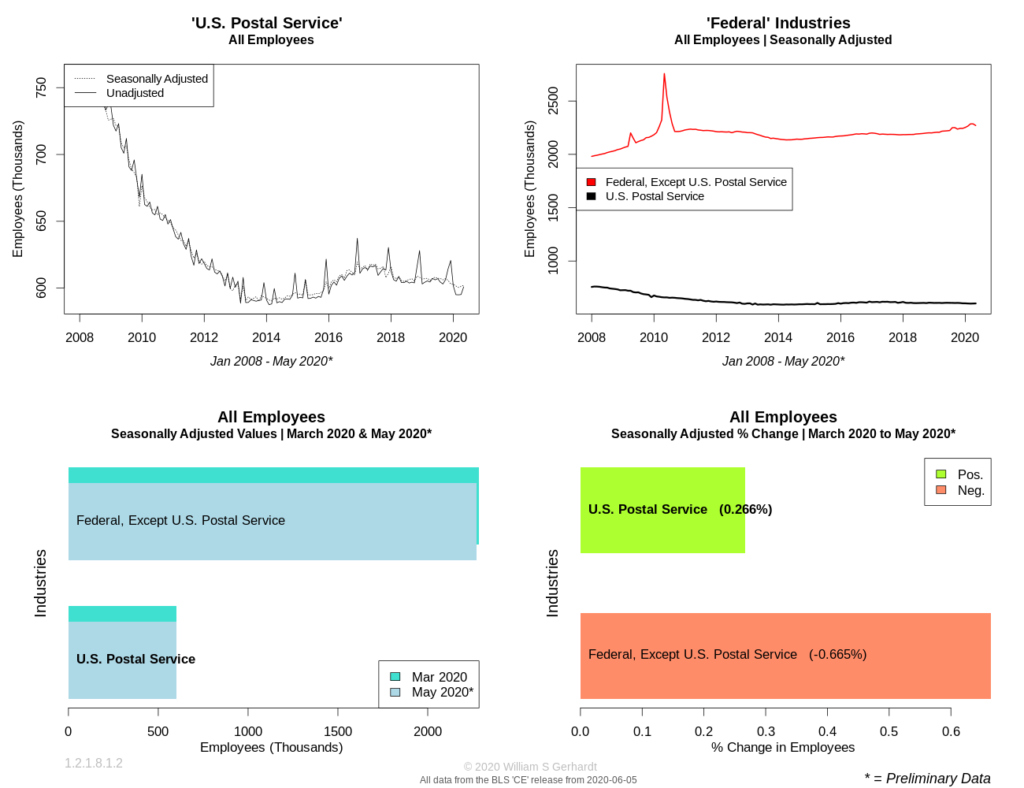

3) The U.S. Postal Service

The gains in the U.S. Postal service mirror job gains in the Courier industry.

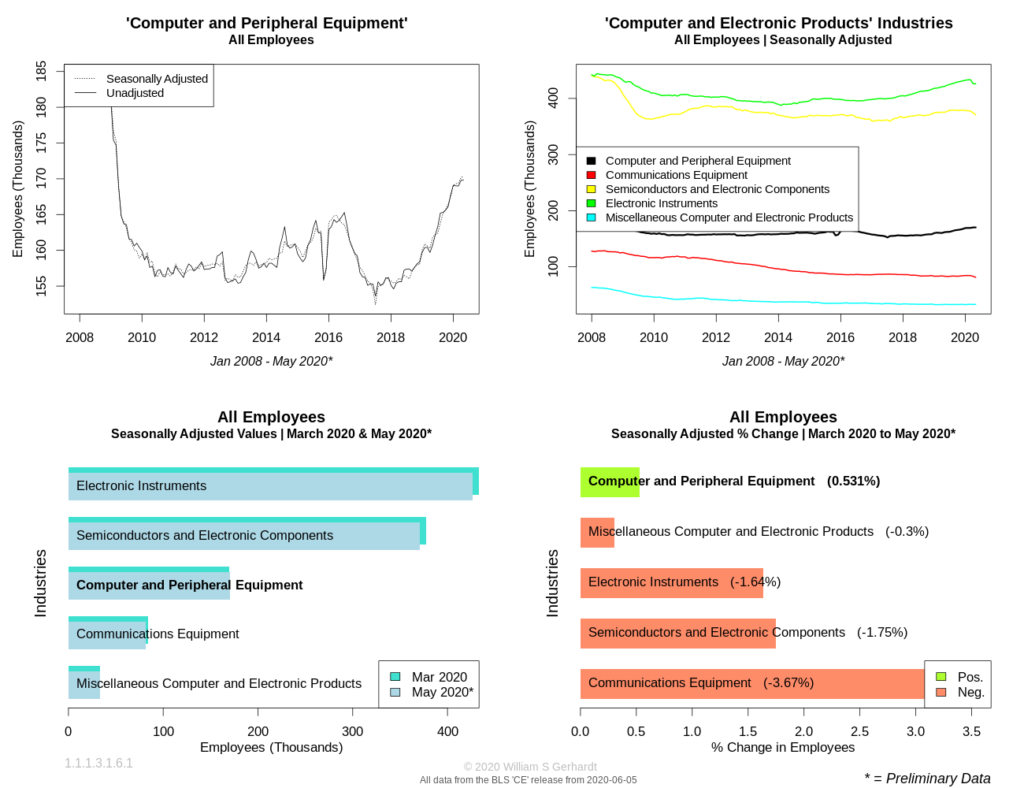

4) Computer and Peripheral Equipment

This is another employment category untouched by COVID-19. The stable and positive employment in this industry may be explained by remote work practices popularized by the pandemic. After all, if you are working from home you are going to need computers and monitors to work at home successfully.

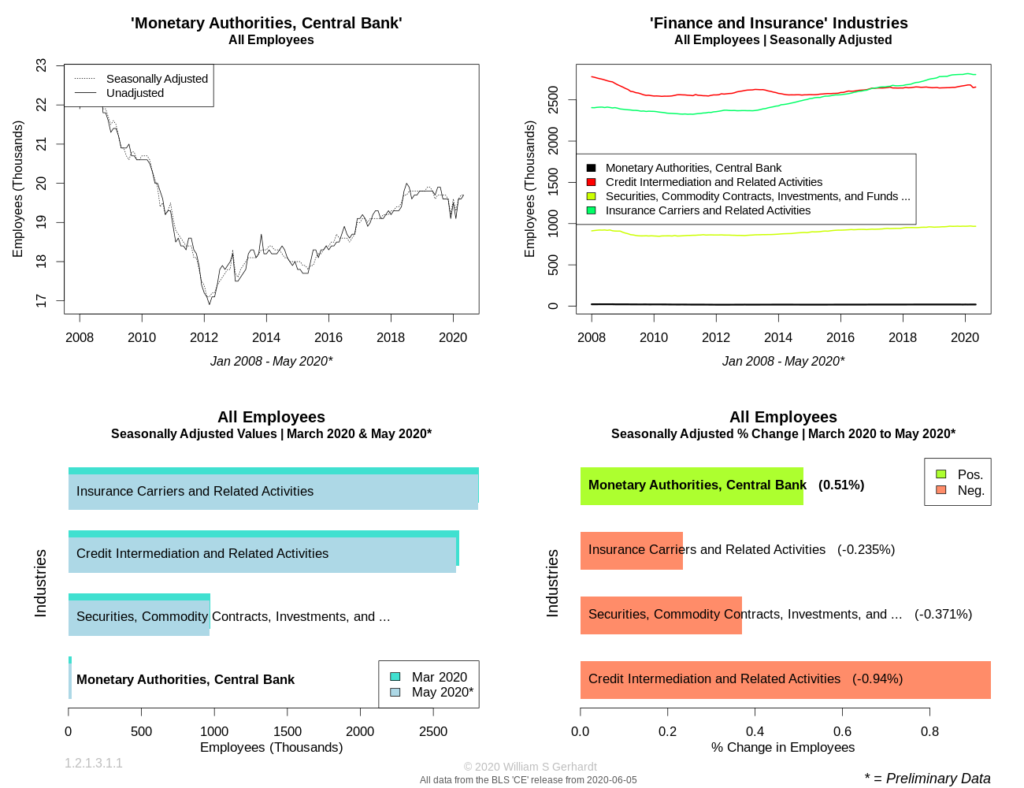

5) Monetary Authorities, Central Bank

While I suspect that U.S. Federal Reserve Banks may be among the most exciting places to work at right now, the category is rather boring when it comes to employment in April and May.

The lack of employment changes in Monetary Authorities should probably give anyone who believes the Fed is going to rescue the economy pause. If the Fed is actually planning on going forward with a reported $500+ billion purchasing of private sector debt on the public market they would likely need to first acquire and train a small army of staff to ensure they don’t accidentally buy worthless private assets; a risk that is less than hypothetical, as many “investment grade” corporate bonds—according to a New York Federal Reserve Bank assessment—looked similar to junk-grade bonds even before the coronavirus pandemic hit. (The amount of corporate debt totaled $9.5 Trillion at the end of 2019, and there are now reports of large and previously profitable companies taking on long-term debt to pay off their short-term debt obligations. Signs of risk are everywhere if you read the major financial publications: FT, Reuters, Bloomberg, and the WSJ.)

So, has the Fed hired the small army of staff needed to properly sort, categorize, and vet hundreds of billions of dollars in potentially high-risk debt? According to the BLS—which reasonably claims to report government-related employment with near perfect accuracy—it has not. It will be interesting to see what happens to Monetary Authority employment in the months ahead; if the Fed is serious about buying debt from municipal bond markets or others markets I would expect the employment numbers in this category to surge.

UP NEXT: The Bad